National Outlooks

Welcome to Cornerstone LATAM!

Cornerstone’s LATAM members are in 7 of the main countries in the region. Each Cornerstone search firm helps clients fill key positions wherever they are required. Our success is built on being a network of local firms with global capabilities. Whether supporting clients in their local area, collaborating with other Cornerstone members in the region, or linking with Cornerstone members around the globe, LATAM members provide their clients with the highest level of service.

Recent studies reflect the demand for workers is more pronounced in emerging markets. This is particularly true for Latin America. At the same time Latin America is known for their technology, soft skills and creative production talent. Our members have access to this talent and can effectively help clients around the world.

For more than 34 years we have had a strong presence in the Executive Search industry, leading searches for companies across a variety of industries, functions, and locations. We know every search requires a dedicated team that understands the needs and goals of each client. Our success is proven by the many clients who repeatedly return to us for their recruiting requirements. Why? Because we provide best-fit candidates that positively impact their organizations for years.

As part of the Association of Executive Search and Leadership Consultants (AESC), we hold ourselves to the highest quality standards. We search both locally and around the globe to deliver leaders of the highest caliber to our clients.

In addition to executive search services, Cornerstone LATAM members offer organizations a variety of tailor-made talent management solutions. Through our solutions, we demonstrate great adherence and commitment to our mission: to have a positive impact on people’s lives. We believe organizations need outstanding resources to retain and develop great talent, and we make these resources available to our clients. These include Executive Coaching, Assessments and Board & CEO Advisory Consulting.

Paulo Stoll

Paulo Stoll is Executive Manager in Cornerstone Talent Acquisition, one of Cornerstone’s verticals in Peru’s operation. Experience Paulo Stoll is a professional with more than 8 years of experience in the management of leading global companies. In his professional career, he has held various positions in companies such as Interbank, Aenza (former Graña y Montero…

Gianfranco Terzi

Gianfranco Terzi is Executive Manager in Cornerstone Talent Acquisition, one of Cornerstone’s verticals in Peru’s operation. Experience Gianfranco is senior consultant in executive, professional search and has expertise in strategic talent acquisition projects like RPOs (rectruitment process outsourcing) and trainee programs. He has more than 7 years of experience in global leading consulting companies and…

María Amalia Arízaga

María Amalia Arízaga is the Manager Sector Lead of Cornerstone Ecuador. She is in charge of all of the strategic, commercial and client development services of Cornerstone Ecuador. Previous Experience She is a senior executive and strategic consultant with extensive experience in Executive Search, Communications, Human Resources Project Management, Change Management Projects and Organizational Development…

Puémape, Daniella

Daniella Puémape is Cornerstone Career Services Manager, one of Cornerstone´s verticals in Peru’s operation. Previous Experience Daniella is senior executive in Career Transition Programs and expert in the enhancement of employability skills. She has previously worked in the Telecommunication, Retail and Consultancy sector, among national and international companies. Additional Professional Activities Daniella has wide experience…

Larrabure, Enori

Enori Larrabure is Cornerstone Talent Management Manager, one of Cornerstone´s verticals in Peru’s operation. Previous Experience She is a senior executive and strategic consultant in Talent Management, with experience in various Human Resources processes such as talent acquisition, training and development, focused in employability, career transition, leadership development and transformational project management related to strategic…

Chocano, Paola

Paola Chocano is Partner & Managing Director of Cornerstone Career Services and Cornerstone Talent Management in Peru’s operation. Previous Experience Paola is senior executive and consultant in Talent Management, focused on employability and career transition, as on leadership and team management. She has experience in organizational strategies, based on communication, climate, culture and talent identification,…

Cornerstone Ecuador

Cornerstone International Group’s presence in Ecuador is provided by a team of professionals based in Quito and Guayaquil. Our Ecuador Partner, Diego Cubas, also lead our offices in Peru, Mexico, Miami and Panamá with more than 17 years of experience in the sector. Like these countries in the region, the primary business offering in Ecuador is Executive Search accompanied by a comprehensive assortment of services such as Leadership Assessment, Executive Coaching,…

Villavicencio, Guadalupe

Guadalupe Villavicencio is the Mexico Director & Senior Human Resources Business Manager of the Cornerstone Mexico office. She completed the Business Administration Bachelor’s degree (ITESM) and worked internationally at Procter & Gamble International Operations for eight years.

Segura, Guillermo

Guillermo Segura is the Managing Partner of Cornerstone Panama. As a consultant, he mainly focuses on Board, CEO, General and Commercial management assignments. Previous Experience Guillermo is a transformational leader, with extensive accomplishments as CEO, General Manager, Commercial and Sales Capability Director in top multinational companies like P&G and in expanding Latin American companies. He is…

Cornerstone Panama

Cornerstone International Group’s presence in Panama is provided by a team of professionals based in Panama City. Our Panama Partners also lead our offices in Peru and Mexico, with more than 15 years of experience in the sector. As in Peru and Mexico, the primary business offering in Panama is Executive Search accompanied by a comprehensive assortment of services such as Leadership Assessment, Executive Coaching, and Board Search. President Manuel Cubas has over 30 years of…

Jaimes, Juleymar

Coaching Approach I am working with individuals and teams who are focused on achieving their goals and building a fulfilling career – individuals who are keen to take time to reflect and have their thinking challenged. I work with clients to build a safe environment that provides time to step back from the day-to-day role…

Door, Gonzalo

Gonzalo Door is the Managing Director of Cornerstone Mexico and a Regional Partner of Cornerstone Mexico, Panama, and Miami. He has over 30 years of top management responsibilities as General Manager and Director of Commercial Sales, as well as Talent Development Manager with leading multinational Consumer Goods Corporations (e.g., Procter & Gamble, Supermax). His business…

Fonseca, Fabio

Co-founder of Havik , Fabio is responsible for Insurance and Healthcare Practices .He has more than 15 years of experience in Insurance, Banking and Human Capital Consultancy. Prior to joining Havik he served in executive positions at Bradesco Seguros, BankBoston and Aon Hewitt. With his team, he was responsible for hiring over 150 executives for…

Cornerstone Brazil

Havik is Cornerstone International Group’s member office in Brazil, located in Sao Paulo. It is an Executive Search Boutique that differentiates the way to look at your own business. We seek to see the processes and projects in which we participate through the eyes of those who come to us. What makes human capital the…

Arce, Adriana

Adriana Arce is specialized in the Executive Search and Recruitment practice for the Information and Technology, Retail and Services sectors. She graduated in Psychology with an MBA at the Universidad Latina of Costa Rica. She has been working in the Human Talent sector since 1986. Adriana is a subject matter expert in areas of Organizational…

Lopez, Miguel

Miguel Lopez has been the Managing Partner at Recluta, Cornerstone’s new member in Costa Rica, since 2012. The boutique executive search firm provides innovative and personalized services in the Executive Search, Recruitment, Outplacement and Job Coaching marketplace. Before founding Recluta, Miguel served for 15 years in positions of increased responsibility at Delta Air Lines in…

Wong, Robert

Robert graduated from the American Chapel School in Sao Paulo, graduated in Engineering from the Polytechnic University of São Paulo and received a scholarship as a Confederation of British Industry Scholar to undertake his graduate studies in the UK. He participated in the extension program for Executive Education at Harvard Business School. He was president…

Sintes de Tellez, Lina

Lina Sintes, Partner & Managing Director at Cornerstone Colombia, has more than 12 years of experience as an Executive Search consultant. She developed her professional executive search consulting practice in several industries in the Spanish and Colombian markets, providing talent assessment and recruitment services to a wide variety of international and local corporations.Previously, she worked…

Cornerstone Colombia

Cornerstone Colombia is one of the most effective talent acquisition and consulting firms, with more than 8 years of experience, knowledge, and perspective of the local market positioning senior executives in top-tier companies. Cornerstone Colombia is Cornerstone’s member office in this country and one of six Cornerstone offices in Latin America. Cornerstone Colombia has an…

Cubas, Diego

Most of my clients are from multinational and national companies with overseas operations. In most cases I work with Entrepreneurs, HR professionals, Sales and Marketing executives and middle managers that need to develop skills to continue growing. They tend to work with me as partners and fully trust in my coaching skills, global vision and…

Cubas, Manuel

Most of my clients are from multinationals and national companies with overseas operations. In most cases I work with CEOs, General Managers, VPs and Directors, Entrepreneurs, most C Level executives that need to develop skills to continue growing in their careers. They tend to work with me as partners and fully trust in my coaching…

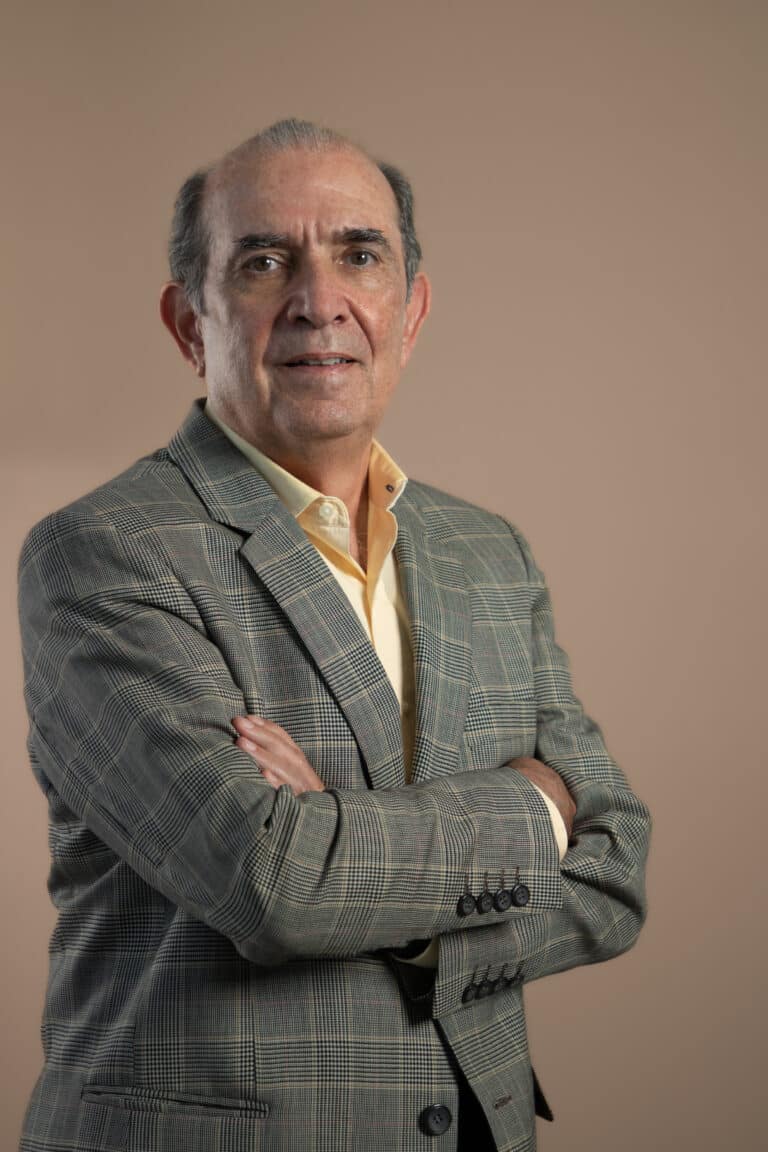

Sintes, Gustavo

Gustavo Sintes Partner and Director at Cornerstone Colombia with more than 45 years of experience in the financial services industry and strategic consulting and talent management. He began his career at Citibank Colombia where he finally held the position of Head of Corporate Banking. After Citibank, Gustavo was named Marketing Vice President of Banco de…

Cornerstone Mexico

Cornerstone International Group’s presence in Mexico is provided by a team of professionals based in Mexico City. Our Mexico partners also lead our Peru office with more than 10 years of experience in the sector. As in Peru, the primary business offering in Mexico is Executive Search accompanied by a comprehensive assortment of services such…

Cornerstone Miami

We are a retained Executive Search and Leadership Development firm that provides professional, personalized solutions with world-class results. Our mission is to serve by providing the highest quality service, always keeping our clients at the center of everything we do. The members of the Cornerstone Miami team have earned a solid reputation as creative, dynamic, and coordinated…

Cubas, Manuel

Manuel Cubas is the founder and President of Cornerstone Perú, México, Panamá, Miami and Ecuador. Previous Experience He has more tan 20 years of managerial experience in global leading companies as Procter & Gamble Peru and Clorox Peru. Manuel also is past President of the Human Resources Committe of the American Chamber of Commerce and…

Cornerstone Peru

Cornerstone Peru is one of the most recognized executive recruiting firms in the local market due to our experience in combination with the professionalism and market knowledge that we own. Our consultants have extensive experience in placing senior executives in top companies. We are considered as a creative, dynamic and a coordinated team of professionals…

Bono, Ornella

Ornella Bono is the co-founder of Humanitas/ Cornerstone Santiago and has been a partner since 2002. She is deeply experienced in CEO and C-Suite searches for industrial sectors, such as construction and real-estate, among others. In the public sector, she oversees civil service processes (Top Public Management) and other State-owned companies. Her other areas of…

Cornerstone Chile

Humanitas has experience in the search of the best executives for C-Suites positions and Bord members. Humanitas experience allows for it to be an ally of their clients, where the consulting firm is positioned as a Leadership Team advisor. Humanitas’ Executive Search team its recognized by their abilities to understand the businesses of their clients,…

Cubas, Sandra

Sandra Cubas is Managing Partner in Cornerstone Perú and Cornerstone Ecuador. Previous Experience Sandra is senior consultant in executive search and competencies-based interviews. She has experience in commercial and marketing strategies, including demand planning and brand building, with emphasis on consumer goods. She worked previously in Belcorp, the third largest cosmetics company in Latin America….

Cubas, Diego

Diego Cubas is the Regional Managing Partner of Cornerstone Peru, Mexico, Ecuador, Panama, and Miami. As well as being Chairman of the Latin America region of Cornerstone International Group, he is also a Global Chair of the Cornerstone network. As a consultant, he mainly focuses on board, CEO, and senior HR and Commercial management assignments. He is a senior…